Today, Bitcoin’s price surged above $105,000, following a major breakthrough in US-China trade negotiations. The king coin hit a price high of $105,705 as trading activity surged across the financial markets.

Although it has since witnessed a slight pullback, bullish pressure remains strong across BTC’s spot and derivatives markets, indicating the likelihood of a sustained price rally.

BTC Hits $105,000 Amid US-China Trade Deal

On Monday, the two economic superpowers, the US and China, announced a 90-day tariff relief deal, which sparked renewed optimism across global markets. As part of the agreement, the United States will lower tariffs on Chinese imports from 145% to 30%, while China will reduce tariffs on US goods from 125% to 10% over the same period.

The announcement triggered a spike in trading activity in the crypto market, pushing BTC’s price above the psychological $105,000 mark for the first time in weeks. Moments later, the coin peaked at $105,705 and witnessed a decline.

While its price has since dipped to trade at $104,397 at press time, on-chain indicators signal a huge bullish presence across the markets.

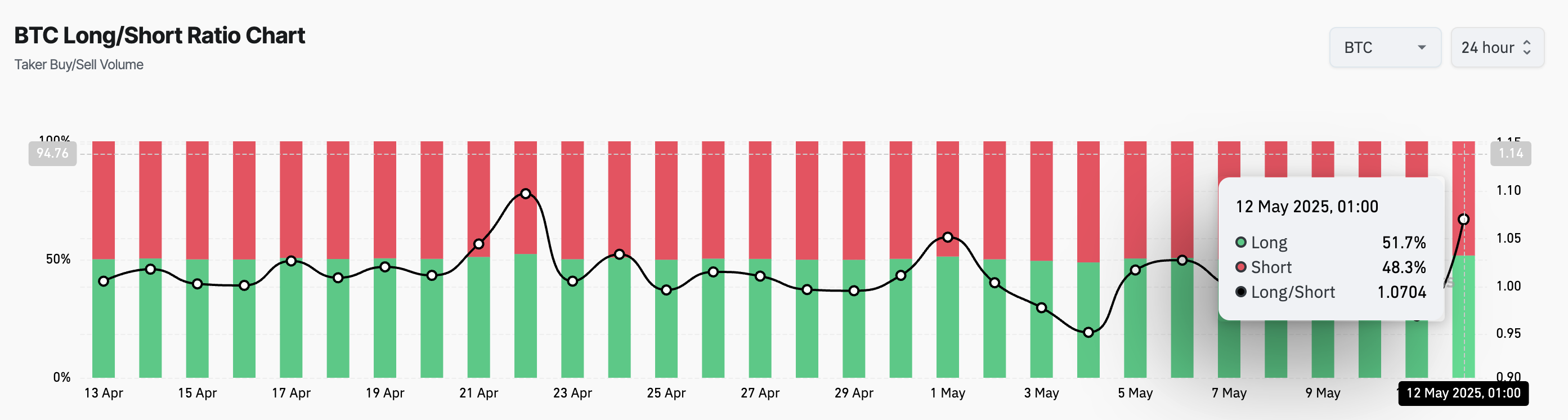

For example, the coin’s Long/Short Ratio reflects the bullish bias toward it in the futures market. At press time, this stands at 1.07.

This ratio compares the number of long positions (bets that the price will rise) to short positions (bets that the price will fall) in a market. When its value is less than one, traders are betting on an asset’s price drop.

Conversely, when an asset’s Long/Short Ratio exceeds 1, it indicates that there are more long positions than short, suggesting that traders are primarily betting on a price increase.

This suggests that the market sentiment is largely bullish among BTC’s future traders, and traders expect a sustained price increase in the short term.

Further, the trend in the coin’s options market, where demand for call contracts has surged, supports this bullish outlook.

When the demand for call options exceeds that for puts in the coin’s options market, it signals a growing bullish sentiment, with more traders betting on upward price movement.

Bitcoin’s Surge Faces a Test

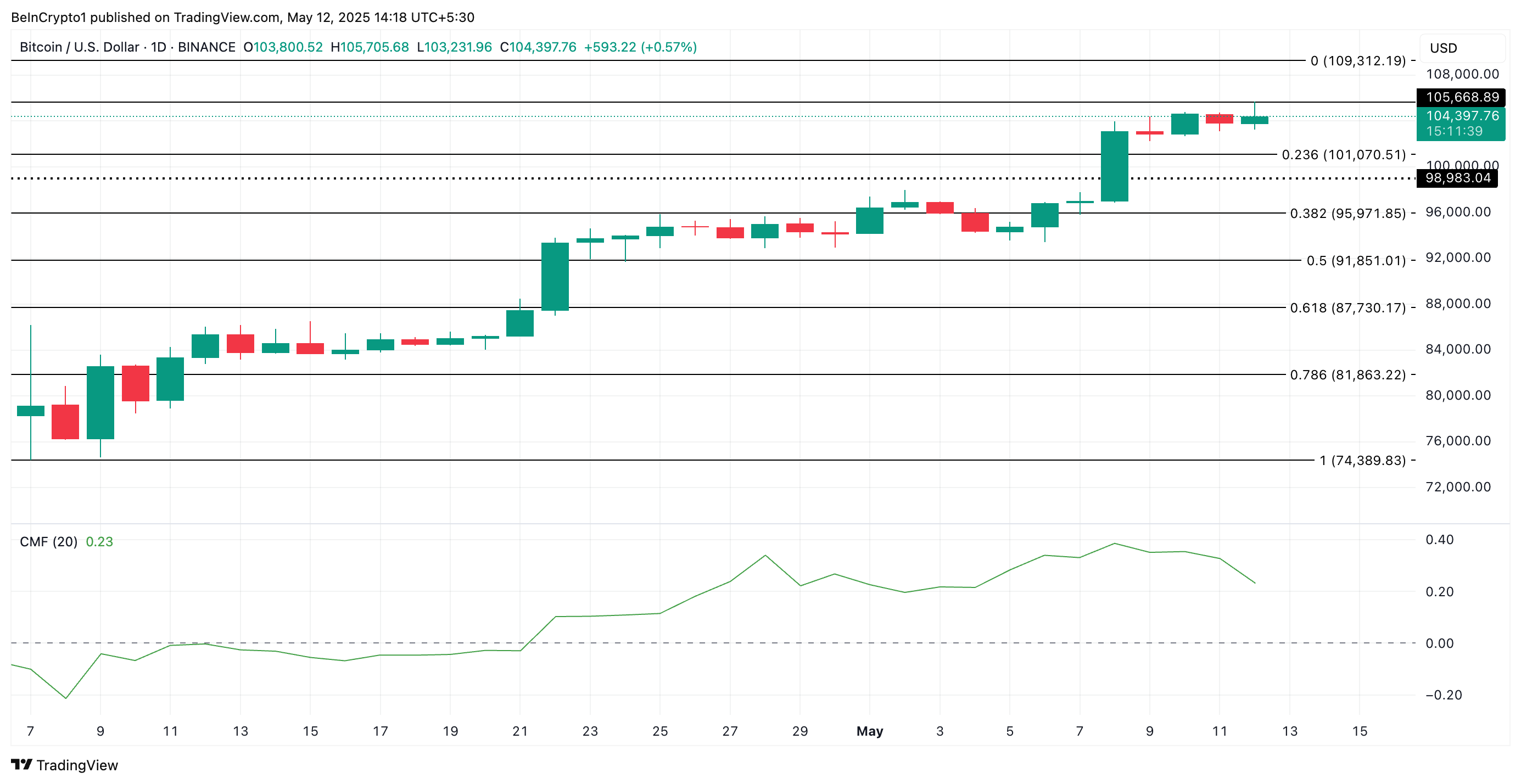

This increase in bullish derivatives activity often reflects a broader expectation of rising prices among BTC investors. If buying pressure is sustained, the coin could climb back above $105,000. If the potential support at $105,668 holds, it could push BTC toward its all-time high of $109,312.

However, on the daily chart, BTC’s Chaikin Money Flow (CMF) has begun to drop, forming a bearish divergence with its price.

A divergence emerges when an asset’s price moves in one direction, but an indicator like the CMF moves in the opposite direction.

In this case, while BTC’s price is climbing, the CMF is dropping, signaling a decrease in buying pressure. If this continues, BTC’s price could fall to $101,070.

The post Bitcoin Breaks $105,000 as Truce Between US and China Sparks Market Optimism appeared first on BeInCrypto.