As the cryptocurrency market continues to heat up, Ethereum (ETH) is gaining considerable attention due to its impressive price rally. This surge has not only generated optimism about Ethereum’s future but has also prompted many analysts to question whether Ethereum can surpass Bitcoin (BTC) and become the leading digital asset.

This article dives into the key arguments from analysts who support this possibility.

Technical Analysis: Why Ethereum Could Overtake Bitcoin?

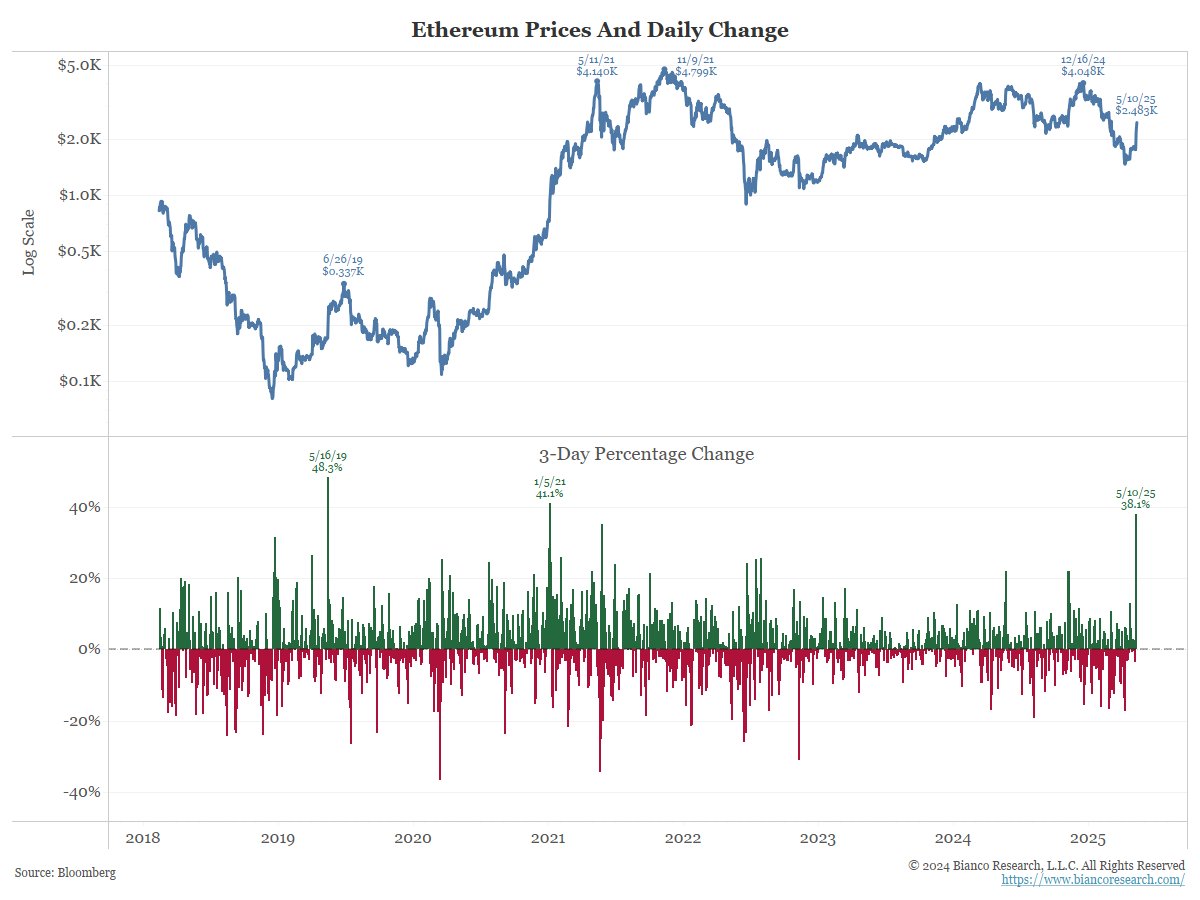

Jim Bianco from BiancoResearch noted that ETH surged 38% within just 72 hours. This marks the largest three-day gain since January 2021 and the second-largest in the past eight years.

At the time of writing, ETH was hovering around $2,450. This level wiped out nearly all the losses from the past two months. Such a sharp move suggests the rally could continue for at least another month, as seen in 2019. It could even kick off a new bullish cycle, similar to what happened in 2021.

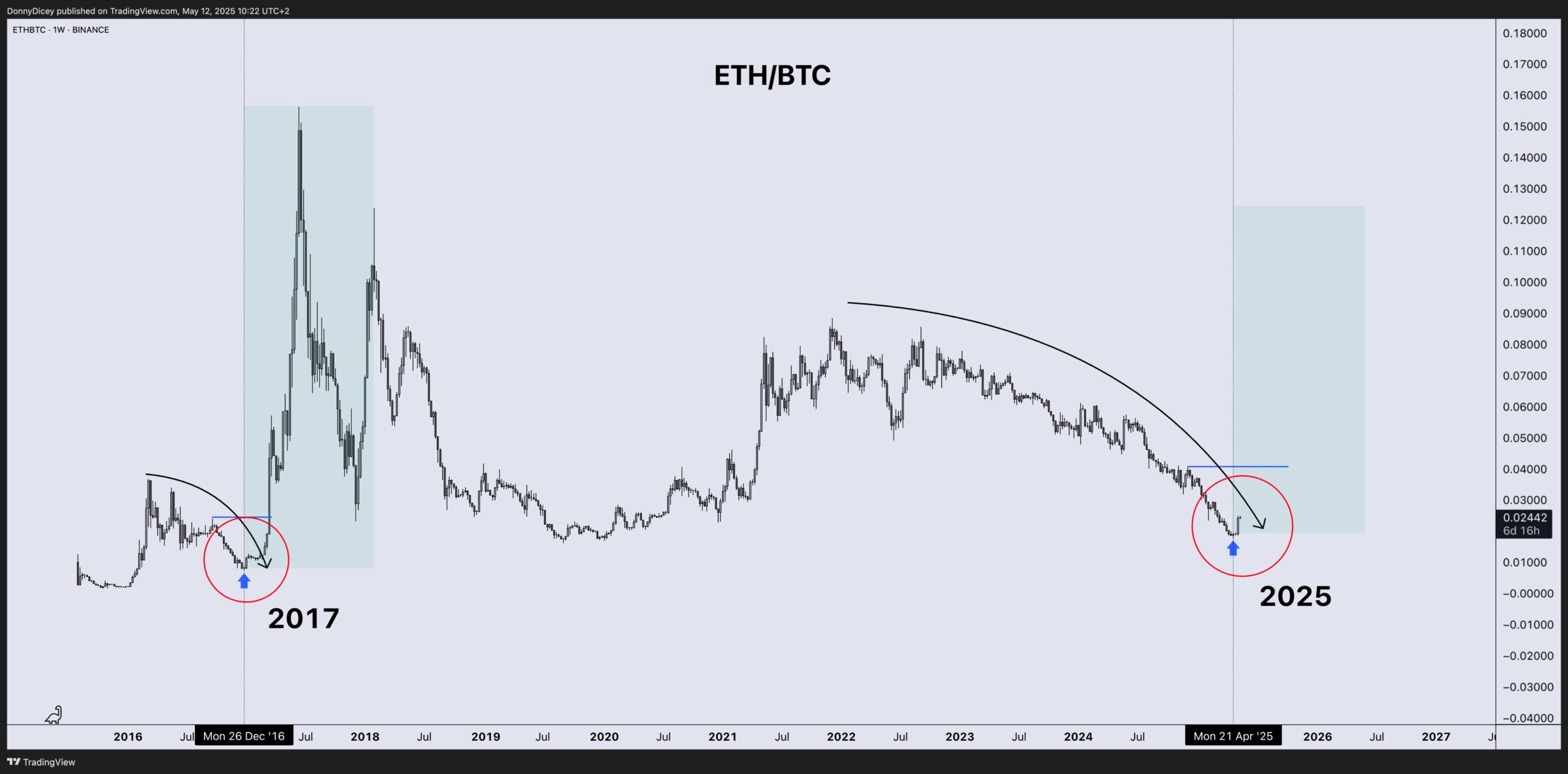

From a technical perspective, the ETH/BTC chart shows strong recovery signals. Analyst Donny observed that the current setup resembles 2017, when Ethereum significantly outperformed Bitcoin.

“ETH is absolutely killing Bitcoin right now. Ethereum could become the number 1 digital asset soon at this rate. Bitcoin Maxi’s in disbelief!” – Investor Gordon said.

Many other analysts echoed this view, emphasizing that ETH’s growth could signal the beginning of an altcoin boom.

Fundamental Factors Supporting Ethereum’s Potential to Overtake Bitcoin

On the fundamental side, Ethereum is gaining strength through growing institutional interest. Nick Tomaino, General Partner at 1confirmation, highlighted that Ethereum is the dominant platform driving most of the innovation in the crypto space. It is attracting attention from major investors.

“Ethereum is the dominant platform for stablecoins, DeFi, NFTs, prediction markets, decentralized identity, decentralized social and more. It’s where the best developers and companies like Coinbase, BlackRock, Fidelity, Stripe, Kraken, Deutsche Bank, Sony, Visa, Polymarket, Uniswap, Aave, Opensea and more are building. It’s trusted by the best and the protocol is constantly evolving,” Nick said.

While Nick acknowledged Bitcoin’s long-term value, he argued that BTC has become a traditional institutional asset favored by big companies and governments. However, it lacks useful applications for onboarding users. Based on that, he predicted that ETH might eventually flip BTC.

Moreover, the anticipation of ETH-based staking ETFs and the tokenization of real-world assets (RWA) by institutions like BlackRock is further boosting Ethereum’s appeal. These factors enhance liquidity and significantly increase ETH’s long-term value.

Given its current growth trajectory, many experts believe ETH could break $4,000 in 2025, and possibly reach $10,000 in the near future.

Georgie Boy, founder of TheAlienBoyNFT, offered a unique analogy by calling Ethereum the “Noah’s Ark” of the crypto world. According to him, Ethereum is not just an asset. It’s a complete ecosystem capable of guiding the market through volatility.

“Ethereum is the Noah’s Ark of crypto, and Bitcoin’s missing the boat. Bitcoin was a great idea, but the peer-to-peer cash narrative has failed repeatedly. Meanwhile, Ethereum quietly is becoming the settlement layer for the modern internet,” Georgie Boy said.

A Balanced Perspective: ETH and BTC Are Both Essential

Despite the optimistic outlook for Ethereum, some neutral perspectives suggest that comparing ETH and BTC is unnecessary. According to The Prophet, the crypto world needs both Bitcoin and Ethereum. Each serves a different purpose.

Bitcoin acts as “digital gold” and a store of value. Ethereum, on the other hand, is the infrastructure for decentralized applications.

He stressed that there’s no real “battle” between the two.

“This is not a fight between two assets. It is a reflection of the two archetypes every system needs:

• The immovable object (BTC).

• The adaptive force (ETH).Bitcoin is the foundation. Ethereum is the scaffolding. You don’t flip the foundation. You build on top of it. But the world doesn’t run on one layer of belief. It runs on layers that reinforce and check each other. ETH doesn’t need to flip BTC to win. It needs to complete it,” The Prophet said.

Regardless of the current optimism, recent observations point to a lack of retail investor participation, even as BTC crosses $100,000 and ETH reaches $2,500. This shortage reflects the cautious sentiment among new investors and could impact the performance of both leading assets in the market.

The post Analysts Point Out Why Ethereum Could Overtake Bitcoin appeared first on BeInCrypto.