Zcash faced a sudden governance shock this week that sent its price sharply lower. Panic selling pushed ZEC down more than 20% yesterday alone, briefly dipping near the $380 level before buyers stepped in. Since that low, the Zcash price has rebounded roughly 17% and is now trading back above $440.

While the immediate fear has eased, the sell-off left behind technical damage. At the same time, strong buying emerged underneath the drop. Zcash is now caught between a fragile chart structure and a clear accumulation response.

Governance Shock Leaves Zcash in a Bearish Structure With 30% Risk Still Active

The sharp Zcash sell-off followed reports that its core development team had exited. Markets initially interpreted this as a project-level failure, triggering forced selling and a fast breakdown in price. Later clarification showed the move was a governance restructuring, not a protocol issue, which helped stabilize sentiment and spark the rebound.

Despite that recovery, the chart remains vulnerable. Zcash is trading inside a rising wedge on the 12-hour timeframe, a structure that often carries downside risk if support fails.

At the same time, a bearish EMA setup is forming. An Exponential Moving Average (EMA) is a trend indicator that gives more weight to recent prices, making it useful for spotting momentum shifts. On Zcash’s chart, the short-term 20 EMA is moving closer to the slower 50 EMA. When this bearish crossover forms and eventually confirms, it often signals weakening trend strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If Zcash breaks below the wedge’s lower trendline, the projected downside sits near 30%. That target is calculated using the vertical distance between the upper and lower trendlines of the structure. The rebound has reduced immediate panic, but it has not removed this risk.

Whales Step In With $3.2 Million Buying Spree

While the chart weakened, on-chain behavior told a different story. Large holders aggressively accumulated during the sell-off, treating the governance-driven dip as an opportunity.

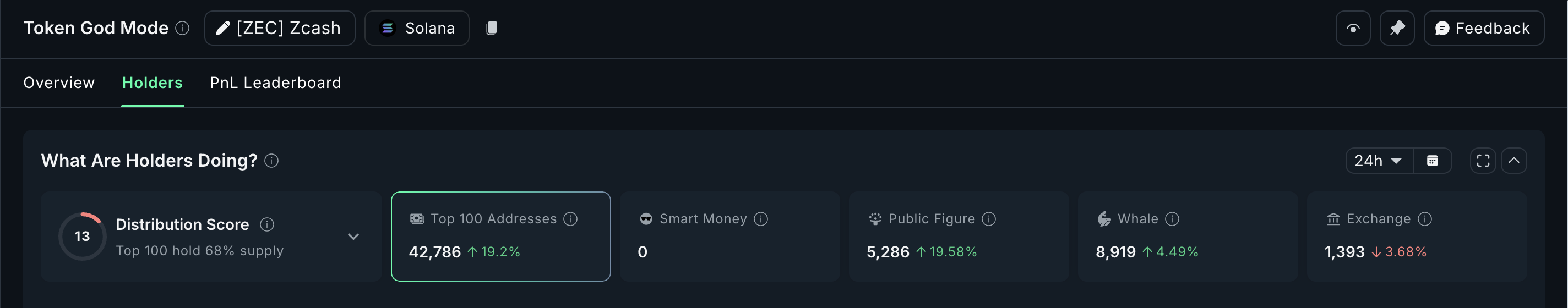

Over the past 24 hours, ZEC whales increased their holdings by 4.49%, lifting their total stash to 8,919 ZEC. That implies roughly 381 ZEC added during the dip. Mega whales were even more active. Their holdings jumped 19.2%, bringing their total to 42,786 ZEC, which translates to about 6,905 ZEC accumulated.

In total, large holders added roughly 7,286 ZEC. At a spot price, that equals about $3.2 million in fresh buying.

This accumulation coincided with falling exchange balances, suggesting coins were being moved into longer-term storage rather than prepared for resale. That buying pressure explains why Zcash rebounded quickly once the initial panic faded.

Still, accumulation can slow declines and absorb volatility, but it does not automatically reverse a bearish structure.

Falling Development Activity Keeps Zcash Price at a Crossroads

The final variable is development activity. Data shows Zcash’s development score peaked near 21.85 in late December before sliding steadily to around 19.67. That decline began before the governance headlines and has continued since.

Historically, Zcash’s strongest rallies have aligned with rising development activity. The recent slowdown helps explain why the price struggled even before the panic sell-off. While governance clarity reduced fear, it did not reverse this underlying trend.

This matters because Zcash remains one of the strongest long-term performers in the market. The token is still up roughly 66% over the past three months and delivered one of the best performances of 2025. For that strength to resume, development activity likely needs to stabilize and turn higher again. That underrated metric can actually save the price.

From a price perspective, Zcash now sits at a decision point. A sustained move above $456 would improve the short-term outlook and reduce breakdown risk. On the downside, a loss of the wedge’s lower trendline would reopen the 30% downside scenario, with $360, $309, and eventually $272 as key levels to watch.

For now, Zcash is balanced between heavy accumulation and technical fragility. The governance shock created a sharp discount, whales responded decisively, and the next move depends on whether development momentum and price structure can realign.

The post $3.2 Million Accumulation Offsets Zcash’s Governance Shock — But Can It Save the Price? appeared first on BeInCrypto.