Several altcoins face heightened liquidation risks during Christmas week 2026. Liquidation heatmaps show clear imbalances, while Open Interest has surged sharply.

Which altcoins are at risk, and which drivers should investors watch when holding Long or Short positions? The following analysis explains the details.

1. Ethereum (ETH)

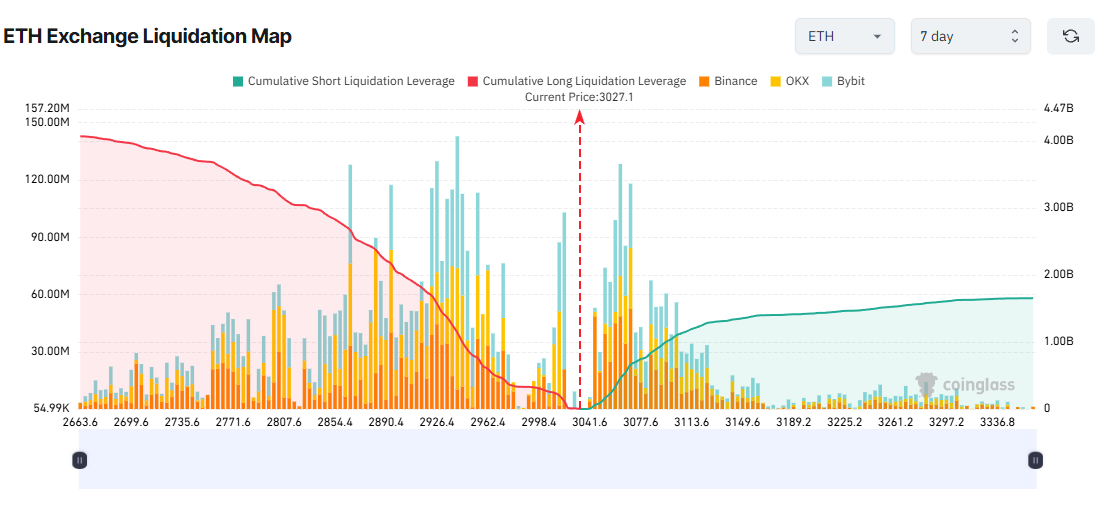

The 7-day ETH liquidation heatmap indicates that potential Long liquidations far exceed short liquidations.

If ETH drops to the $2,660 zone during Christmas week, total Long liquidations could exceed $4 billion. In contrast, total Short liquidations could reach $1.65 billion if ETH rises to $3,370.

Factors Long traders should monitor to reduce risk:

- Arthur Hayes recently transferred 508.6 ETH (approximately $1.5 million) to Galaxy Digital. This move has fueled speculation that he may be reducing exposure to Ethereum.

- The Ethereum Coinbase Premium Index turned negative in the third week of December. If selling pressure from Coinbase intensifies, ETH prices could decline further in the coming days.

- ETH ETF outflows reached $643.9 million last week. This trend reflects broader selling pressure across the market.

If these factors strengthen, they could trigger a sharp bearish scenario. Such a move may lead to large-scale liquidations among Long traders.

2. Midnight (NIGHT)

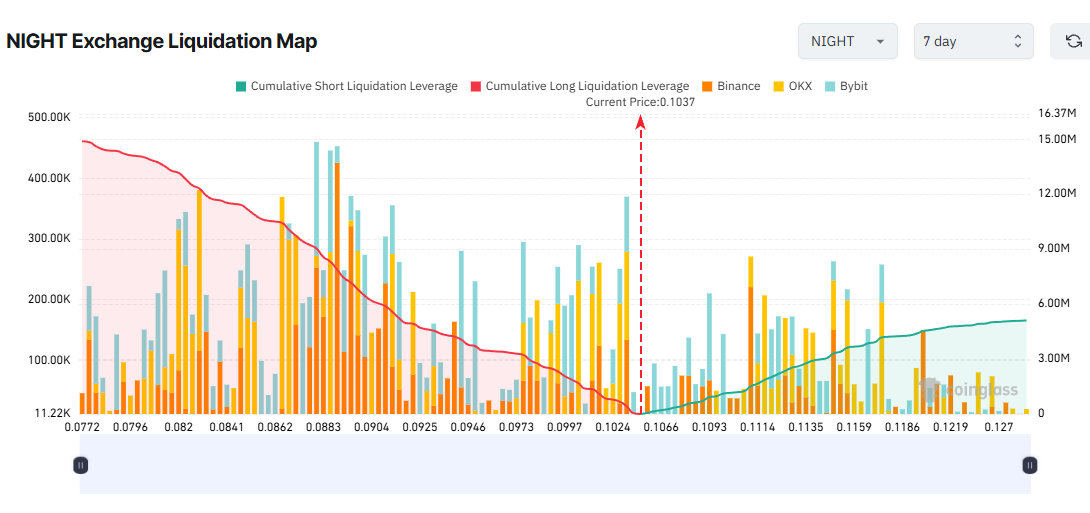

Midnight (NIGHT) has recently attracted significant trader attention. Open Interest surged from $15 million to over $90 million within two weeks.

Liquidation data suggests traders broadly expect NIGHT prices to keep rising. As a result, traders betting on bullish scenarios may face heavier losses due to increased capital and leverage usage.

Cardanians, a company operating Cardano stake pools, reported that NIGHT now records daily trading volume of $6.8 billion. This figure exceeds the combined volumes of SOL, XRP, and BNB. Despite the surge in volume, NIGHT posted its first red daily candle today after seven consecutive days of gains. This signals growing selling pressure.

In addition, investor Plutus, citing DexHunter data, stated that 100% of current NIGHT holders who bought on the market are in profit. These holders may take profits at any time.

These signals serve as a warning that profit-taking pressure on NIGHT could intensify this week.

Liquidation heatmaps show that if NIGHT falls to $0.077, cumulative Long liquidations could reach $15 million.

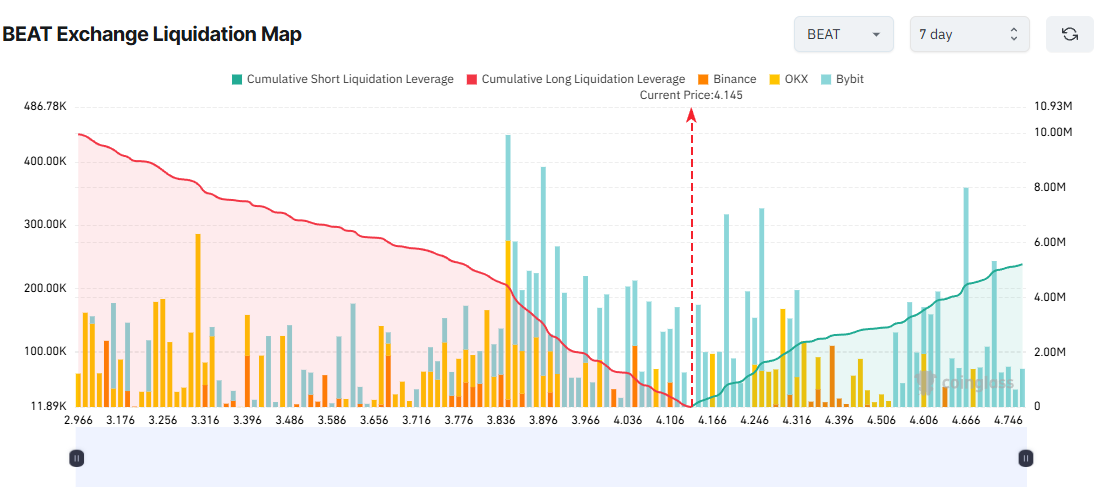

3. Audiera (BEAT)

A recent BeInCrypto report revealed that BEAT has surged more than 5,000% since its launch in November. The token reached an all-time high of $4.99.

However, many traders appear unsatisfied and continue to expect further upside. This sentiment seems in the liquidation data, where potential Long liquidations significantly outweigh Short liquidations.

Some traders have raised concerns about possible price manipulation. These concerns draw parallels to the 75% collapse of Bitlight (LIGHT). Supporting observations include:

- BEAT dropped 30% within one hour, then rebounded 50% in just one minute. Sudden price fluctuations could be the result of manipulation by large wallets.

- Audiera’s official website remains inaccessible. The project’s official X account shows no updates beyond posts announcing BEAT as a top gainer.

Market data platform CoinAnk has issued warnings about the risk of liquidation.

“In a negative funding rate environment, although the cost of holding short positions remains low, extreme volatility in $BEAT can easily trigger cascading liquidations—affecting both long and short positions,” CoinAnk stated.

If BEAT falls below $3, total Long liquidations could reach $10 million.

The post 3 Altcoins That Could Face Major Liquidation Risks During Christmas Week appeared first on BeInCrypto.