Bitcoin recently reached a new all-time high (ATH) but encountered a brief pullback as the market overheated.

However, with the resilience in the ETF market, Bitcoin has largely returned to normalcy. With substantial ETF inflows, Bitcoin’s price could soon push past its previous ATH.

Bitcoin is Ready To Bounce Back

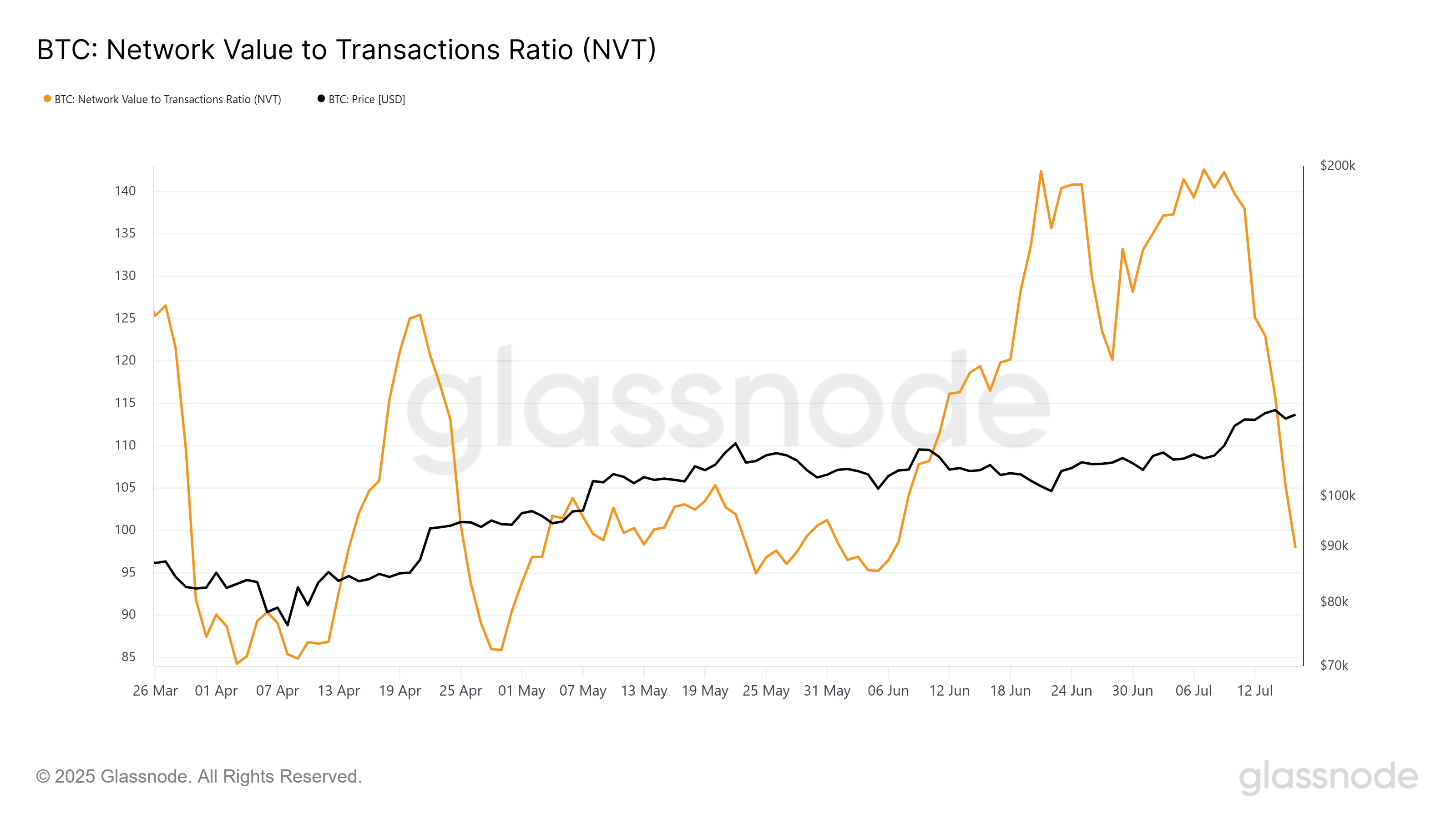

The Network Value to Transaction (NVT) Ratio spiked earlier this month, following a similar spike in June. The NVT Ratio measures the relationship between the network value and transaction activity.

A rising NVT Ratio suggests the network value was exceeding the transaction activity, which generally is a sign of the market overheating. This tends to result in a reversal.

The same was evident in Bitcoin’s recent dip, as the market cooled off. Nevertheless, currently, the NVT Ratio has returned to a monthly low, providing Bitcoin with room for a potential rally.

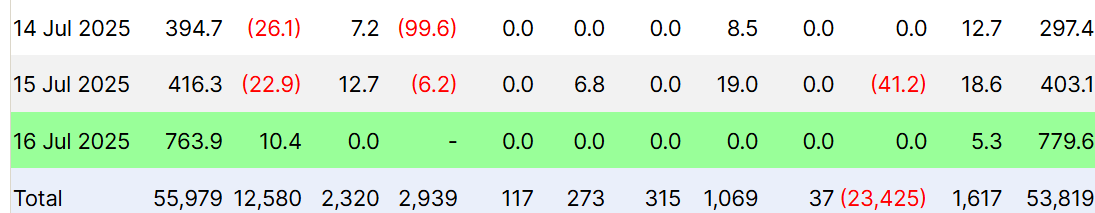

This week, spot Bitcoin exchange-traded funds (ETFs) saw over $1.5 billion in inflows, a significant portion of which occurred in the last 48 hours during Bitcoin’s dip. The influx of institutional money highlights that investors are confident in Bitcoin’s potential despite the market cooling.

These ETF inflows demonstrate resilience among institutional investors, who are continuing to add Bitcoin to their portfolios rather than sell. If this trend persists, it could propel Bitcoin’s price upward, as institutional support provides stability.

BTC Price Is Inches From The All-Time High

Bitcoin is currently trading at $118,325, facing resistance at the $120,000 level. This resistance is crucial for Bitcoin if it wants to break back to its ATH of $123,218. The 4.1% gap to reach the ATH indicates potential for growth, but Bitcoin needs to secure support above $120,000 for this to happen.

If Bitcoin can hold above $120,000 and push past $122,000, it could continue its ascent toward new all-time highs. The current market conditions and ETF inflows support a bullish outlook, with a significant chance of breaking the resistance.

However, the risk of profit-taking remains, which could lead to a price drop. If Bitcoin faces selling pressure, it could fall back to $115,000, erasing a portion of recent gains. This would invalidate the bullish thesis, causing Bitcoin to retest lower support levels.

The post $1.5 Billion ETF Inflows Could Push Bitcoin Price 4% to New All-Time High appeared first on BeInCrypto.