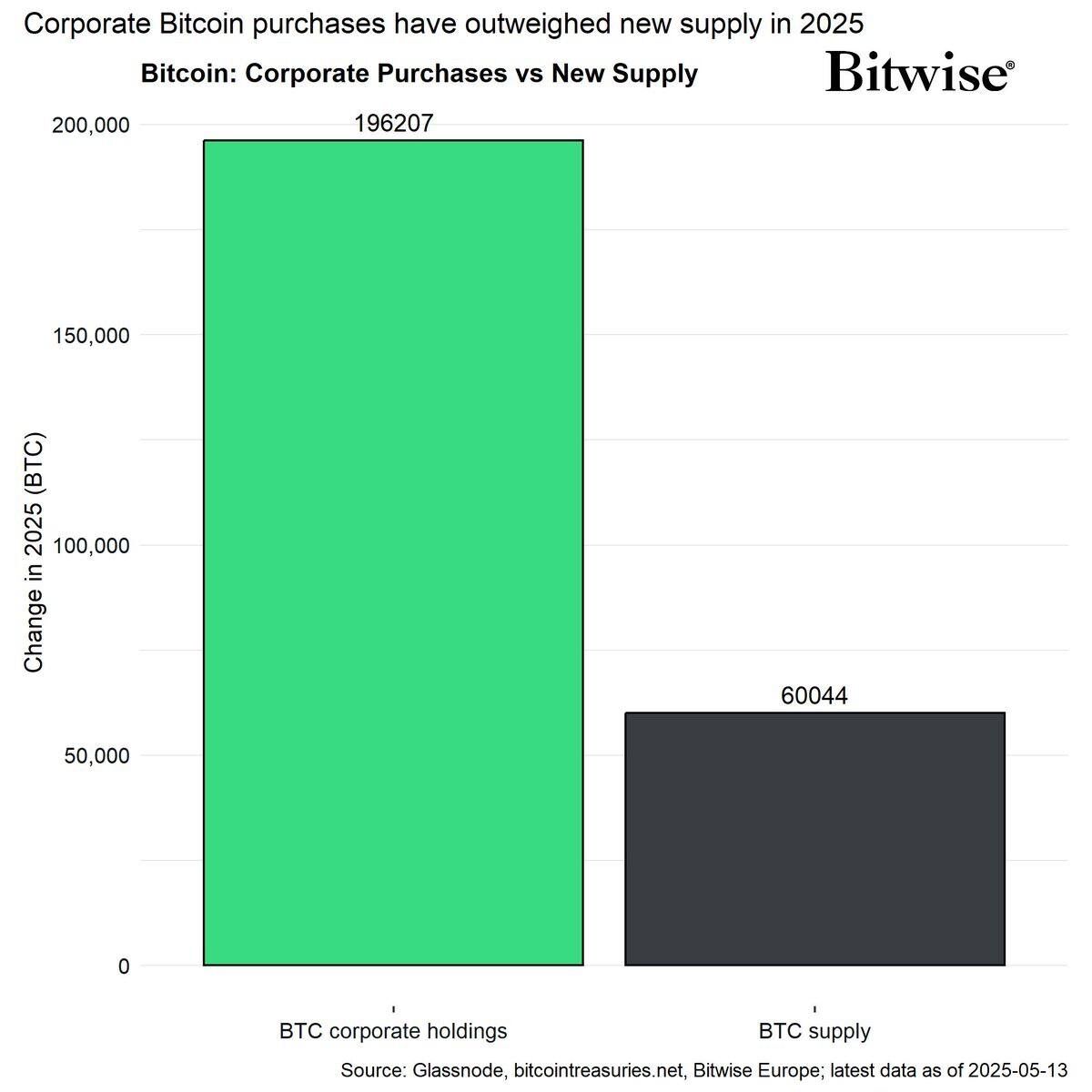

In 2025, corporations have become the largest net buyers of Bitcoin, significantly outpacing both exchange-traded funds (ETFs) and individual investors. Businesses have collectively added approximately 157,000 BTC, valued at around $16 billion, to their holdings this year. Notably, MicroStrategy, led by Michael Saylor, is responsible for 77% of this corporate accumulation. Corporate Bitcoin purchases have exceeded the new supply of Bitcoin by a factor of 3.3, with companies buying 3.3 BTC for every 1 BTC mined. This demand dynamic has rendered Bitcoin effectively deflationary, as corporate and ETF buying surpasses new issuance. Fidelity has highlighted that companies not achieving a 65% return on invested capital might consider investing in Bitcoin instead. Furthermore, businesses allocating just 3% of their cash reserves to Bitcoin have seen a 20% increase in purchasing power, contrasting with negative real returns for those maintaining cash or money market positions.

This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz.

To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io