Ethereum remains locked in a corrective phase, with the price struggling to reclaim key resistance levels despite recent rebound attempts. While downside momentum has slowed, the market has yet to show the demand strength required to transition into a sustained bullish continuation.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ETH continues to trade below a dominant descending trendline that has capped the price action since the November peak. Each recovery attempt has stalled beneath this structure, reinforcing the broader corrective bias.

The asset is currently trading around the $3,1K level, below both the 100-day and 200-day moving averages. The 200-day moving average near the $3,4K to $3,5K zone aligns with a major daily supply area, which previously acted as a distribution region and continues to attract selling pressure.

Above current levels, the $3,3K to $3,6K zone remains the most critical resistance. A daily close above this area would be required to invalidate the descending structure and signal a potential trend shift. Until then, upside moves are likely to remain corrective in nature.

On the downside, the $2.6K to $2.5K demand zone stands out as the most significant support area. This region represents the origin of the strongest bullish impulse earlier in the cycle and sits near the lower boundary of the broader market structure. A revisit of this zone would still be structurally consistent with the ongoing correction.

The 4-Hour Chart

The 4-hour chart shows Ethereum trading inside a rising corrective channel nested within the larger downtrend. While higher lows have formed in the short term, the asset remains capped by both the descending trendline and a local supply zone around $3,3 to $3,4.

Recent price action shows repeated rejections from this resistance cluster, followed by shallow pullbacks rather than impulsive continuation. This behaviour suggests absorption rather than aggressive buying.

If Ethereum fails to reclaim the $3.3K level with strength, downside liquidity is likely to be targeted near the $3K psychological level, followed by the $2.9K support region highlighted on the chart. A breakdown from the rising channel would increase the probability of a deeper move toward the daily demand zone.

Only a clean break above the descending trendline, accompanied by strong follow-through, would shift short-term momentum decisively in favour of buyers.

Onchain Analysis

By Shayan

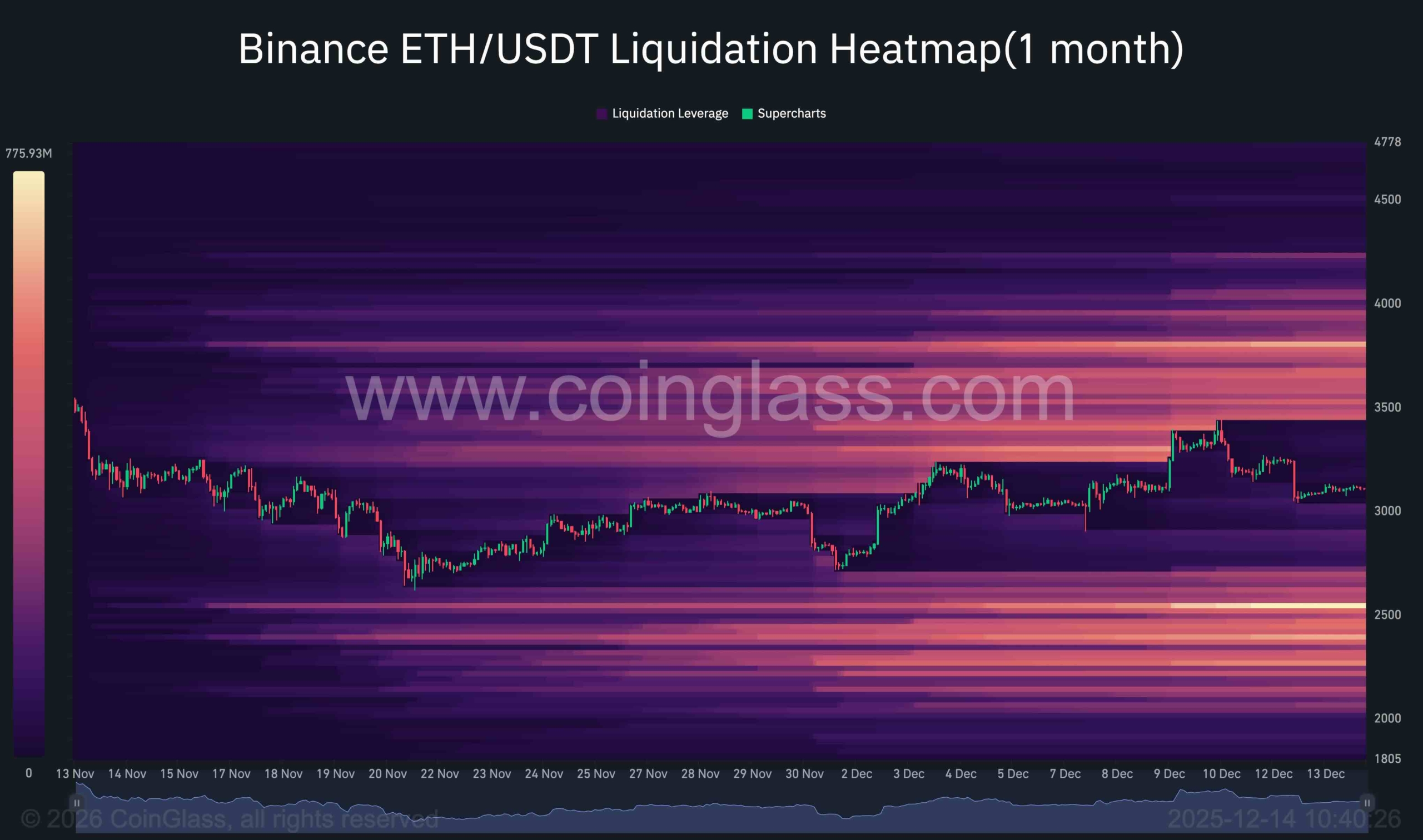

The Binance ETH/USDT liquidation heatmap provides valuable insight into where leveraged positions are concentrated and how the price is likely to interact with those liquidity pools. Over the past month, the heatmap reveals a dense cluster of liquidation levels stacked above the current price, particularly between $3,4 and $3,7.

This concentration suggests that a large number of short positions are positioned in that range, making it a magnet for the asset if sufficient momentum emerges. However, ETH has repeatedly failed to move decisively toward this liquidity, indicating a lack of aggressive demand capable of triggering a short squeeze.

Below current levels, liquidation density appears thinner in the immediate range, with the next notable cluster forming closer to the $2.7 to $2.6 area. This imbalance implies that downside moves may encounter less resistance in the short term, increasing the probability of a liquidity-driven sweep lower before any sustained upside expansion.

Historically, Ethereum tends to move toward areas of highest liquidation concentration once momentum aligns. At present, the market structure and liquidation profile suggest that price may need to first flush remaining weak long positions to the downside before enough fuel exists for a meaningful push higher.

Until liquidation clusters above are actively engaged and cleared, Ethereum remains vulnerable to continued range-bound or corrective price action rather than a clean bullish breakout.

The post Ethereum Price Analysis: ETH Still Vulnerable to Sub-$3K Drop as Bearish Momentum Persists appeared first on CryptoPotato.