Nasdaq has submitted a groundbreaking proposal to the U.S. Securities and Exchange Commission (SEC) that could transform the operational framework of Bitcoin exchange-traded funds (ETFs). The proposal, focused on BlackRock’s iShares Bitcoin Trust (IBIT), seeks to introduce “in-kind” bitcoin redemptions, offering a streamlined and cost-effective alternative to the current cash redemption process.

JUST IN: BlackRock files to allow in-kind creations and redemptions for its spot Bitcoin ETF! pic.twitter.com/SSigX4utRG

— Bitcoin Magazine (@BitcoinMagazine) January 24, 2025

What Are In-Kind Redemptions?

Under the proposed system, institutional players known as authorized participants (APs) – responsible for creating and redeeming ETF shares – could opt to exchange ETF shares directly for bitcoin rather than cash. This innovation eliminates the need to sell bitcoin to generate cash for redemptions, simplifying the process while cutting operational costs.

While this option would only be available to institutional participants and not retail investors, experts suggest that the improved efficiency could indirectly benefit everyday investors. By reducing operational hurdles, in-kind redemptions have the potential to make Bitcoin ETFs more streamlined and cost-efficient for all market participants.

Related: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Price Amid Inflation Worries

Why the Change?

The cash redemption model, implemented in January 2024 when spot Bitcoin ETFs were first approved by the SEC, was designed to keep financial institutions and brokers from handling bitcoin directly. This approach prioritized regulatory simplicity during the nascent stages of Bitcoin ETFs.

However, the rapid growth of the Bitcoin ETF market has created new opportunities to improve its infrastructure. With evolving regulations and a more mature digital asset ecosystem, Nasdaq and BlackRock now see a pathway to adopt a more efficient in-kind redemption model.

Benefits of In-Kind Redemptions

- Operational Efficiency:

- Reduces the complexity and number of steps in the redemption process.

- Streamlines ETF operations, saving both time and costs.

- Tax Advantages:

- Avoiding the sale of bitcoin minimizes capital gains distributions, making ETFs more tax-efficient for institutional investors.

- Market Stability:

- Reduces sell pressure on bitcoin during redemptions, potentially stabilizing the asset’s price.

Regulatory and Market Context

Nasdaq’s proposal coincides with significant regulatory developments under the pro-Bitcoin Trump administration. Recent policy shifts, such as the repeal of Staff Accounting Bulletin 121 (SAB 121), have paved the way for broader cryptocurrency adoption. The removal of SAB 121 eliminated barriers that previously discouraged banks from offering cryptocurrency custody services, creating a more favorable environment for innovations like Nasdaq’s in-kind redemption model.

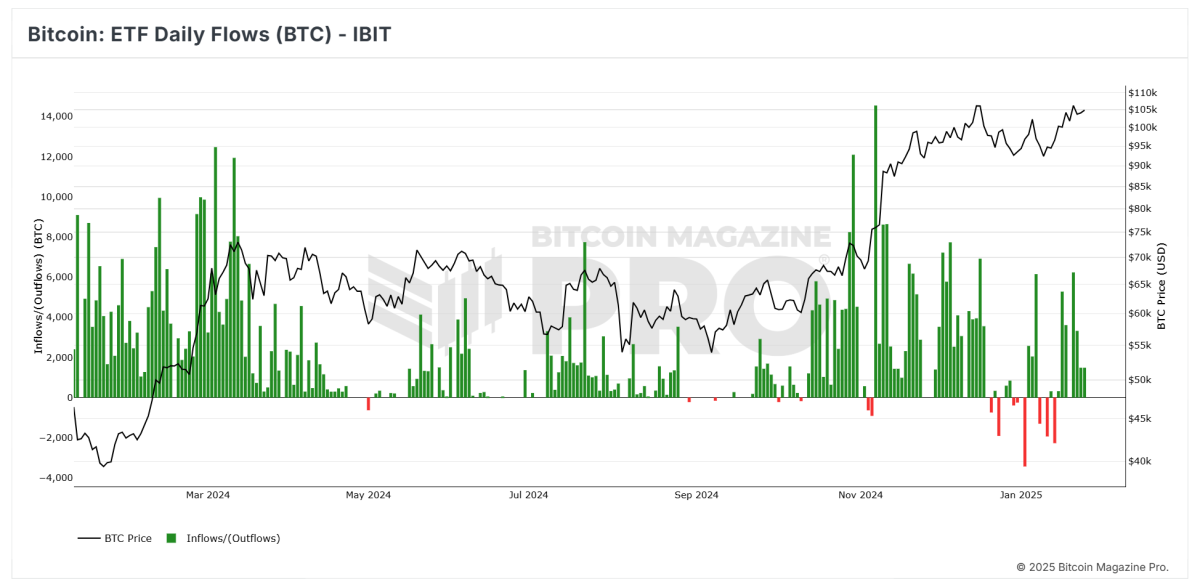

BlackRock’s Bitcoin ETF: A Market Leader

Since its 2024 launch, BlackRock’s iShares Bitcoin ETF has emerged as a market leader, with over $60 billion in inflows. The fund’s consistent growth highlights institutional demand for Bitcoin investment products. Innovations like Nasdaq’s in-kind redemption model could further enhance IBIT’s appeal to institutional investors.

Note the consistent upward trend of green candles, reflecting strong and steady inflows.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Nasdaq’s proposal to introduce in-kind redemptions for BlackRock’s Bitcoin ETF represents a pivotal moment for the Bitcoin ETF market. By simplifying redemption processes, offering tax efficiencies, and reducing sell pressure on bitcoin, the model stands to significantly enhance the appeal and performance of Bitcoin ETFs for institutional investors.

As the Bitcoin ETF market matures and regulatory support continues to grow, innovations like this are poised to drive further adoption. If approved, Nasdaq’s proposal could mark a critical step forward, solidifying Bitcoin ETFs as a cornerstone of institutional digital asset investment while indirectly benefiting retail participants.

With a favorable regulatory climate and growing institutional interest, the future of Bitcoin ETFs looks brighter than ever.